Products

Gold is the oldest precious metal known to man and for thousands of years it has been valued as a global currency, a commodity, an investment and simply an object of beauty.

Our Products

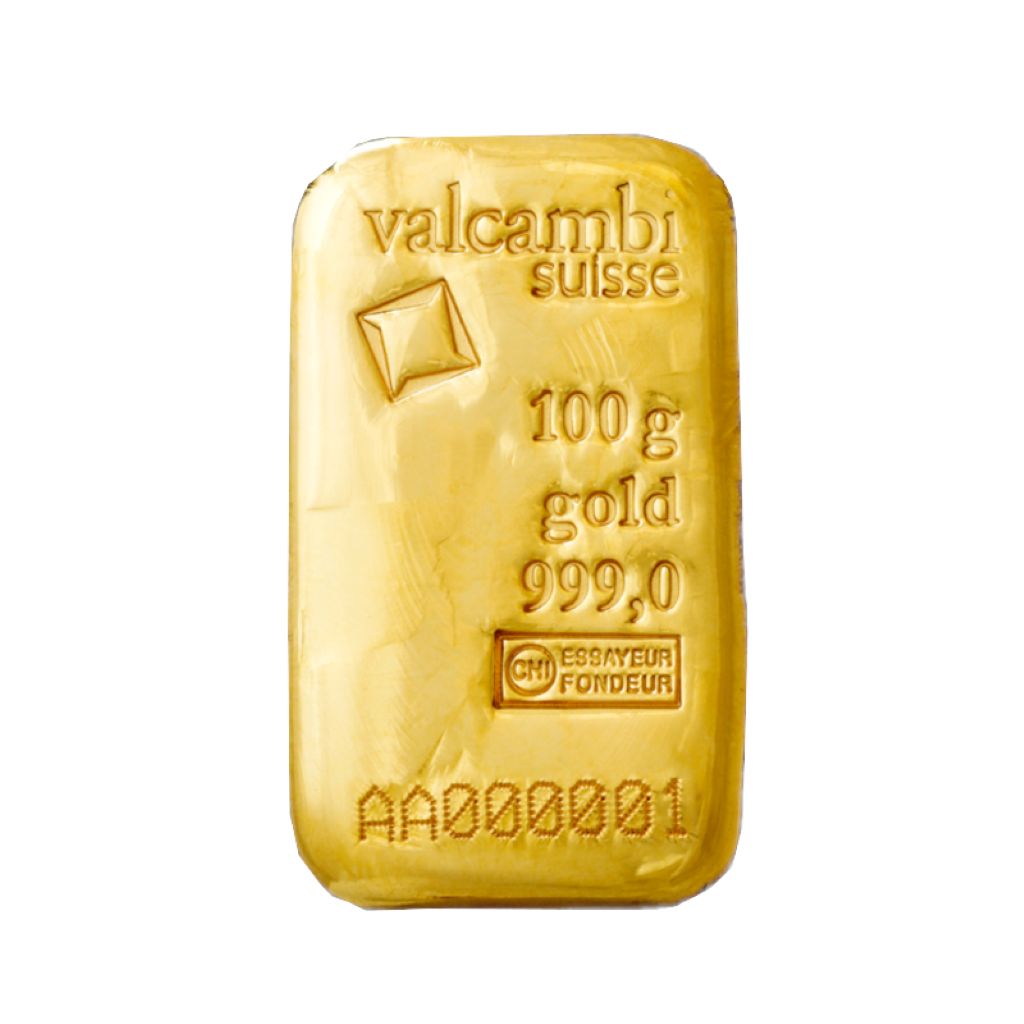

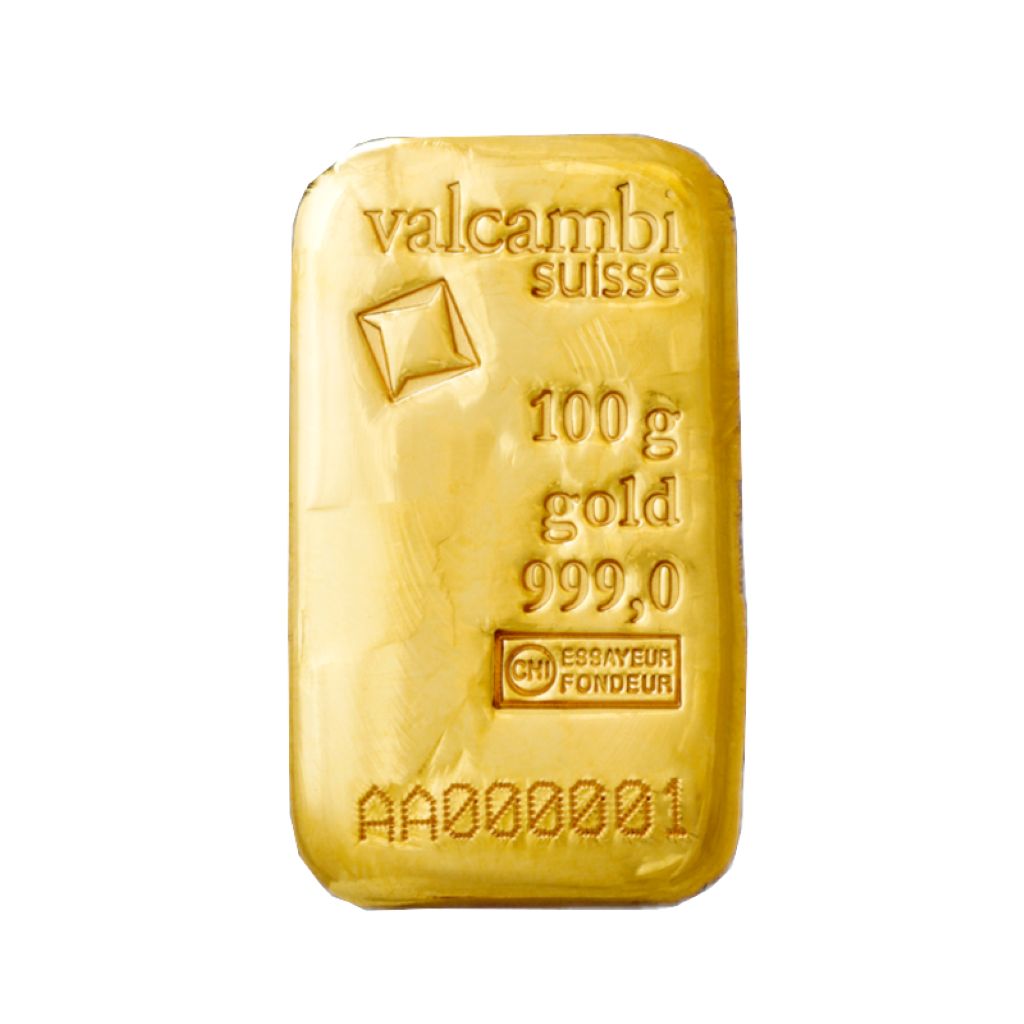

Bullion Bar

Get the purest gold bar.

Value Added Investment Bars

An effective way to diversify your investment portfolio

Gold Coins

Get the purest gold coins.

Major Characteristics

- Gold (Chemical Symbol-Au) is primarily a monetary asset and partly a commodity.

- Gold is the world’s oldest international currency.

- Gold is an important element of global monetary reserves.

- With regards to investment value, more than two-thirds of gold’s total accumulated holdings is with central banks’ reserves, private players, and held in the form of high-karat jewellery.

- Less than one-third of gold’s total accumulated holdings are used as “commodity” for jewellery in the western markets and industry.

Demand and Supply Scenario

-

Gold demand reached a 10-year high of 3,812.2 tonnes, worth US$150billon, as a

result of

- Strong growth in jewellery demand;

- The revival of the UAE market;

- Strong momentum in Chinese gold demand and

- A paradigm shift in the official sector, where central banks became net purchasers of gold for the first time in 21 years.

- China was the world’s largest gold producer with 340.88 tonnes, followed by the United States and South Africa.

- The total supply of gold coming onto the market reached 4,108 tonnes, a rise of 2%.

Global Scenario

- London is the world’s biggest clearing house.

- Dubai is under UAE liberalised gold regime.

- New York is the home of gold futures trading.

- Zurich is a physical turntable.

- Istanbul, Dubai, Singapore, and Hong Kong are doorways to important consuming regions.

- Tokyo, where TOCOM sets the mood of Japan.

Factors Influencing the Market

- Gold demand reached a 10-year high of 3,812.2 tonnes, worth US$150billon, as a result of

- Above ground supply of gold from central bank’s sale, reclaimed scrap, and official gold loans.

- Hedging interest of producers/miners.

- World macroeconomic factors such as the US Dollar and interest rate, and economic events.

- Commodity-specific events such as the construction of new production facilities or processes, unexpected mine or plant closures, or industry restructuring, all affect metal prices.

- In UAE, gold demand is also determined to a large extent by its price level and volatility.

Purity

- Gold purity is measured in terms of karat and fineness:

- Karat: pure gold is defined as 24 karat

- Fineness: parts per thousand Thus, 18 karat = 18/24 of 1,000 parts = 750 fineness